Top 10 Ways To Save Money

I have found in my quest to achieve financial freedom, it is essential to be disciplined in my spending habits. There are a number of creative ways to save money but first ask yourself why, why are you trying to save money?

Identify your reason and keep this at the forefront of your mind and it will help keep you on the right road.

I did a video that goes more in-depth about a secret strategy the Chinese use that works every time and this is how you can truly save money if you use this method. I go more in depth about it here.

This post contains affiliate links, which means I may receive a small commission, at no cost to you, if you make a purchase through a link.

Get clear about where your money is currently going.

I use a spreadsheet like this because it’s a nice way to capture a snapshot of my income and expenses all in one shot. If you’re into bullet journaling I gathered some pretty cool ideas to help you organize your money here.

I recommend recording your last month’s income and expenses (if you have a consistent monthly income) to get an idea of where your money is going.

Do you often find yourself overspending? Have you ever tried the envelope system?

The envelope system is used for items you usually overspend on like groceries, clothes, gas, etc.

Here’s how it works:

- Figure out how much you can afford to spend on these items each month

- Take out cash for each category and put them in individual envelopes and label each i.e. Groceries

- You can only spend what’s in the envelope for the month, NO exceptions so spend wisely.

Rinse and repeat each month.

This system keeps you accountable and most importantly on track with your budget.

These are my favorite envelopes to use to stay accountable and you can get them from Amazon for the low!

Related: 8 Little-Known Ways to Help You Get Out of Debt

Saving practices are personal choices, this is what works for me. I challenge you to try one or even all and you’ll see an impact on your savings.

If you can make more money, it’s even easier to save. See our most popular article on 30 ways to make money from home.

Below are the Top 10 Ways to Save Money When You are On a Tight Budget

1. How Much Money Are You Spending on Food?

It’s amazing how much we spend on food whether it’s grocery shopping or going out to eat. I could go on and on about how we used to overspend on food but to simplify it; I suggest following these best practices to save money on food:

- Meal Plan – This isn’t for everyone so if you need help you should consider joining the $5 meal plan. For just $5 a month, they will send you a delicious meal plan where every meal will cost about $2 per person, and in most cases less. It’s a great way to eat good for less, and sometimes you just need to know what to eat. Try it for FREE for 14 days here.

- Shop Your Pantry – Instead of following a recipe, try and use the items you already have in your pantry and get rid of that before you spend more money on food. It’s amazing how much food gets wasted in our pantries.

- Online Grocery Shop – Grocery shopping online will actually help you impulse shop less. You can stick to your list and if you shop at places like Walmart they do the shopping for you and load your car for FREE! I love it. You should definitely try it and if you use my link you get $10 off your first purchase!

- Buy In Bulk – Do you have a Sam’s Club or Costco membership? You may find better deals at your local grocery store for certain items, but there are some bulk food store prices that are so hard to beat. Check out this post on 19 Unbeatable Deals You Can Only Find at Costco

- Lighten up on Brand Loyalty – Some Brands are smart choices, they have stood the test of time and we can trust the quality. It’s ok to try an off-brand, they have very similar flavors and a smaller price tag. Take a few tests to try your off brands and see if it works for you and SAVE.

- Couponing – This is a great way to save money, you can experience immediate savings by taking a few minutes to clip coupons. Couponing could also be a good social activity to do with others. Ever heard of Ibotta?

2. Renegotiate your Contracts

Do you have cable, internet, car insurance (hopefully you do), and a phone? If you have not attempted to negotiate a better rate in the past year, do it today or let this awesome app Trim do it for you!

This app is FREE and acts as your personal finance assistant and does all the negotiating for you. Nice huh?

But what’s the catch? Trim makes money by taking 25% of the money they save you, so you know they are working extra hard to save you money.

Click here to start saving money with Trim

By doing a SIMPLE phone call to see how you can lower your monthly bills can save you quite a bit. YOU NEVER KNOW UNLESS YOU ASK.

3. Reconsider Warranties

There are dealerships, phone companies, and stores that make money on the “possibilities” with warranties and insurance. There are times you thank God for having a warranty if a product fails, but there are many cases where you never use it.

Did you know that most credit card companies have automatic warranty doubling? This means that your credit card company automatically extends the warranty on your purchases. For example, if you buy an iPhone and it breaks after Apple’s warranty expires, your credit card company will still cover it up to an additional year.

Most people don’t know this, heck, I didn’t until I read this awesome book I Will Teach you to be Rich. Awesome book, that changed my outlook and lifestyle.

You are taking a risk if you purchase a warranty or not. I look at it this way… if you don’t purchase it, save the money for the “what if” and if you don’t use it you get to keep the money.

Something to consider but it’s good to always weigh the pros and cons before making this important decision.

4. Do you really need cable?

Notice I didn’t ask if you need internet because that’s pretty much non-negotiable in most households. We use Roku, Netflix and you can use Sling for $25 a month for live tv (try it out for 7-days FREE). Sling is nice because you can stop it anytime you want (you are not locked into a contract).

This is a huge lifestyle change, but you could save over $1,000 or more a year.

5. BECOME A DIYer (DO IT YOURSELF)

Nails, Hair, Eyebrows, Home Decor, and even plumbing, car repairs, oil changes can all be performed by you.

Don’t underestimate the power of YouTube and Pinterest, you can literally learn anything, and it will save you a lot of money if you just do it yourself.

6. Live Life for the Free

Libraries, community events, parks, museums (on certain days), walking trails, playdates are all very FREE fun things to do. Make sure to pack a lunch when you do outdoor activities. And don’t forget to make sure you enjoy all the free deals on your birthday.

7. Fly Southwest

So you travel much? Consider flying Southwest Airlines when you do, in addition to the fact that you can change your flight, cancel at no charge, and check your bag for free, you can also buy your ticket and if you see a cheaper price for the same flight after you’ve purchased your ticket you can call up to the day you depart and they’ll credit your account for the difference.

Now, did you know that?

DISCLAIMER: Your credit has to be used within a year.

8. Try Second Hand

Clothes, electronics, home decor, and so many things can all be purchased gently used. Check out your local second-hand stores, and I’m sure you’ll find great deals on practically unworn clothes!

eBay and Craigslist can be your best friends for finding gently used electronics, home decor and more. Don’t count out garage sales and thrift stores. This is called “frugal living”, but it doesn’t have to look like it.

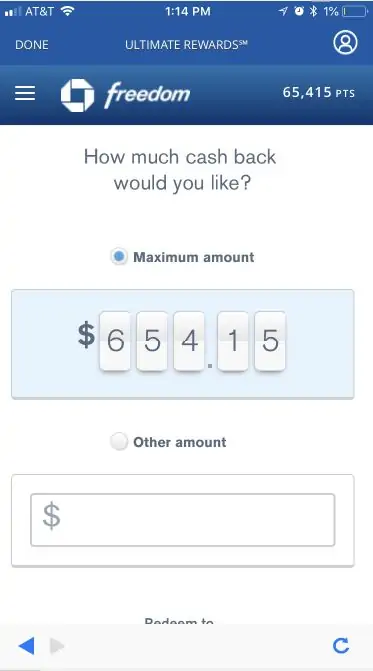

9. Take Advantage of Credit Card Perks

Credit cards are not for everyone. If you find that you cannot pay your monthly bills in full, move on down to the next tip. IF you can, use these to your advantage to save AND make money.

- Use One Credit Card on EVERYTHING

We had over $500 in cashback rewards last year aka my Christmas shopping money. My husband and I put EVERYTHING on our Chase Freedom credit card and pay our bill off every month in FULL (NEVER pay interest, don’t just give your money away). This is FREE money.

The more you charge on your card the more cashback you’ll receive, that’s why I recommend using ONE credit card on everything.

If you sign up for the Chase Freedom Credit card like we did you get a $150 bonus if you spend $500 within the first 3 months. That should be easy to do if you use it on everything like us.

I’m currently at $654.15!

- Trip-cancellation insurance: If you book tickets for a vacation and for whatever reason can no longer go, your credit card company can cover the cancellation fees usually between $3,000 to $10,000 per trip. So, USE A CREDIT CARD.

- Car Rental Insurance: If you already have car insurance you are already covered but ONTOP of that your credit card company will usually back you up to $50,000.

- I already mentioned Automatic Warranty Doubling in #3

I learned these tricks from the book I Will Teach you to be Rich, if I can recommend ANYTHING to you…it’s to buy that book. It has changed my life and it’s only $8.

10. Use Rakuten

Rakuten is one of my favorite money-earning apps because you get cash back for things you’re going to buy anyway, as long as you do it through their app. How? Stores pay Rakuten a commission for sending customers to their store. Rakuten splits that commission with you, so you both win.

I really rack up my Rakuten account during Christmas time. See my January cash back statement, a nice little bonus for shopping online.

Better than nothing, right?

Click here to get $30 when you spend at least $30 online.

But wait…there’s more.

Have you ever heard of Honey? You’ll no longer need to search for coupon codes and sales again! Click on the Honey Google Chrome extension during checkout and Honey will automatically apply coupon codes to your shopping cart

I absolutely love Honey, this is an absolute must-have if you shop on Amazon, it’s saved me so much money.

It’s FREE and you can check it out here.

Bonus Tips

11. Dosh

Dosh is a must-have cash back app, I absolutely LOVE it. It’s all “passive income” (my favorite kind of income) and all you need to do is link your credit/debit card and it will automatically give you cashback when you shop, eat, travel, and more at participating local and national merchants.

I forgot I had this app, and I was out to dinner with my husband for our anniversary and received this email after we paid below

and this keeps happening when I use my credit card at participating merchants!

Downloading this app is a no-brainer. You get a nice little kickback for something you were paying for anyway.

12. Get FREE Oil Changes, Car Repairs & Food as a Secret Shopper

I recently had a GREAT experience as a secret shopper at a restaurant with my family where I had to rate the food, staff, and cleanliness of the restaurant. They actually required that I ordered coffee, two entrees, and Pie! I’m like, okay :-).

I did the survey on my phone while I was there so I wouldn’t forget anything. I took a picture of my receipt and they reimbursed me! A full brunch for my family and I for FREE! They have way more opportunities for oil changes and car repairs which is AMAZING!

I’ll do this any day of the week. You can sign up here and see what opportunities are available in your area. I’d love it if you used my referral id as the person who recommended you, it’s IN35543.

13. Get Cash Back on Groceries

Download the Ibotta App and before you shop, add products you were going to buy anyway. Redeem your offers by taking a photo of your receipt. Ibotta will match the items you bought to the offers you selected and give you the cash!

Your cashback will be deposited into your Ibotta account within 48 hours. I LOVE this app.

Final Thoughts

You also might want to unsubscribe from the mailing lists of your favorite shops. If you don’t see it, you won’t know you need it!.

I hope you found this list valuable and can implement all or some of these today! If you want to see how I’ve been a stay-at-home mom and working towards becoming a millionaire (yeah, sounds crazy right?) check out this article.

If you like content like this, please be sure to subscribe to Tried and True Mom Jobs email list for additional ways to make and save money.

You Might Also Like

10 Creative Ways to Save You Hundreds

52-Week Money Challenge to $10,000

How to Make $10,000 losing weight

17 Ways to Make Money from Your Phone

20 Ways to Make Money from Home

15 Business Ideas to Start this Year

How I retired at 31 with a million dollar portfolio

Love the list! I am with ya on all these suggestions, our family pretty much does the same and we are able to make it on one income in Southern California! Our culture today is just so used to so seeing so many “comforts/conveniences” as necessities. Less is more 🙂

Wow, you’re doing great. One income in Southern California? Nice Job.

I use a similar cashback online platform called SHOPBACK. Didn’t make me a millionaire but it’s good to see some of your hard spent money bring some cash back. haha. And yes you are right, cut back on bottled water and cook it yourself save quite a bit of money.

I’m going to have to check out Shopback I’ve never heard of it before.

I really love this list; very informative. I love the fact you mentioned “Try Second Hand” as this will assist in reducing some cost

Yes, we all need to freshen up our wardrobe from time to time but we don’t have to spend a fortune to do it.

I completely agree with your ideas. They are the simple ideas that can be incorporated with no extra effort. It’s just that we have to be rigid and take an initiative. Thanks for compiling them. Already on the first tip 🙂

Thank you and the first tip is one of the hardest.

I think the only one on here I do not do regulary is Ebates. I do not do enough online shopping to think about it when I do. The bottled water one kills me! It is so easy to refill a Nalgene and be on your way. Saves a ton of money and the environment.

Yes, there are great benefits to not using bottled water.

I love staying organized and budgeting! Thats how the rich get richer!

Yes, so true!

Great tips! I started meal prepping at the start of the new year and it has saved me tons. I prepare everything on Sunday for lunch and dinner for the following week. It’s also been cutting some inches on the waist too!

Yes, meal prepping/planning is great for many reasons. Not easy to do but so worth it.

I joined Meetup.com and there’s a group called “Free or Mostly Free”. Where people just post events/stuff to do for less than $5 (most of it is free). That’s helped me save a ton of money on entertainment over the years. Check it out and see if they got a similar group near your town.

I’ve never heard of that, I’m going to check it out. Thank you!

I have only recently started packing my own lunchbox and it is saving me a lot of money. I need to start bringing my own drink bottles as buying bottled water is my weakness.

Yes, packing your lunch will save you so much and YES try bringing in your own water it’s Free! I definitely understand the convenience of bottled water, it took me awhile to get out of that.

We cut cable years ago and it was the best decision. We didn’t miss it and we really didn’t miss them increasing the rates every 6 months unless we called and negotiated for hours each time. Such a bad business model!

I’m showing my husband this comment, I totally agree. I can’t wait to get rid of cable!

Such a great list! We do all of these things except fly Southwest because we don’t fly often, and the credit card because we have found that we get into more trouble than it’s worth to use one. Thanks for sharing these tips–I’m going to share with friends, too!

Thank you! Yeah, the credit card one is a tricky one but worth it if you can be disciplined

These are great tips! I am already using Ebates for everything love it! The cable one is huge! Nettie

Mooreorlesscooking.com

Thank you and yes, Ebates is the best!

Nice list.

We do all the uk equivalents to this and am now debt and mortgage free. Much happier times.

Thank you and that’s awesome. It is such a joy to be debt free and not owe anyone anything.

Great list. These are really simple and easy but usually ignored habits. Other simple ways are to find a website that offers discount deals and money-saving offers.s

I remember saving a lot of money by calling AT&T to negotiate my bill. They charged me for data overages and I was shocked when they dropped all the charges.