8 Best Ways to Help You Get Out of Debt

How to Get Out of Debt on a Low Income

Do you want to know How to Get Out of Debt quickly?

Whether you’re in debt because of student loans, credit cards, medical reasons, unexpected home repairs, life circumstances or just made some bad decisions along the way… it doesn’t matter, because getting out of debt is possible and I’m going to show you how to do it.

There are a few little-known ways to help you get out of debt in this article, so make sure you “pin it” to refer back to it often.

My hope is by the end of this article you will have a clear plan on how to get out of debt and see the light at the end of the tunnel.

But do you want to know the MOST IMPORTANT way for you to get out of Debt? YOU have got to want it BAD enough.

How bad do you want to get out of Debt?

I love how Steve from Think Save Retire said it in a forum,

“There are a LOT of wickedly awesome tips and techniques for climbing your way out of debt, but none more important than this one (in my humble opinion):

You need to want it!

It’s easy to say that you want to be debt free. It is an admirable goal, no doubt. But without entering the game mentally to see this goal through to the end, you probably won’t make it.

Becoming debt free is a mind game as much as it is a savings game. If we want things bad enough, we tend to do the things necessary to make them happen.

Want it, baby. Want it!”

He is so right! If we want to go on vacation, we’ll save up or put it on a credit card and go. We do what “We Want”.

You have got to want to get out of debt so badly that you’ll sacrifice your vacation until you pay down your debt.

You’ll want it so bad that the thought of eating out is not an option because you know you could save that money by cooking and eating whatever food you already have at home.

You’ll want it so bad that you will sacrifice having the latest fashion and get creative with what you already have AND you’ll learn how to start saying NO to friends for different outings that you know you can’t afford.

You’ll want it so badly that you’d be willing to live like you are broke, living on minimum-wage so you can attack your debt aggressively.

And you’ll STOP borrowing. When standing in a hole the best thing to do is to stop digging.

Remember, this is temporary. Temporary sacrifices for a lifetime of Financial Freedom is so worth it.

I absolutely hate debt now, but that was not always the case. I was always told my student loan debt was “Good Debt” so I did the bare minimum to pay it off, but when I got married I didn’t think it was fair for my husband to take on my debt (he was debt-free).

It was time to focus on getting rid of my debt.

We also bought a truck that dug us deeper in the hole, but 5 years later, I can finally say at the age of 30 I am finally debt free from Student Loans, Car note, and almost Mortgage Free!

Side Note: I do not consider a mortgage apart of the debt I’m talking about in this article BUT if you can pay it off, go for it!

I will share some tips on how I was able to get rid of most of my debt later in this article.

But as far as paying off my mortgage, that’s all attributed from the income from my blog but that’s another subject for another day. If you want to see how I make money blogging you can check it out here.

I love hearing get out of debt stories and I planned to have a couple in this article but every person I was going to interview took basically the same steps to become debt-free.

So, to avoid being redundant I’m going to focus on the steps they took (and myself) to become debt-free.

This post contains affiliate links, which means I may receive a small commission, at no cost to you, if you make a purchase through a link.

Here are the Steps to Get Out of Debt Fast

1. Make A List of Your Debts and use the Snowball Method

For some, you could figure this out in your head, but for others, you might want to get out a pencil and paper and write down all the debts you owe and use the Dave Ramsey Snowball approach below:

- Make a list of your debts and the amount you owe for each one

- Make a plan to pay off your debts from smallest to largest

- Make the minimum payments on all your other debts except the smallest

- Pay as much as possible on your smallest debt and then repeat these steps until all your debts are paid in full

Plug your numbers in this FREE calculator and it will generate an easy-to-follow payment plan using the snowball method. HIGHLY RECOMMENDED.

Click here to put your numbers in.

It’s the small wins that will push you towards the next goal, it’s a psychological boost. Seeing regular progress motivates you to keep going.

BUT you shouldn’t do this UNTIL all of your bills are current, and you have at least $1,000 in a savings account for emergencies.

2. Create a Monthly Budget

Now that you have an idea of what you’ll need to pay and how much, it’s time to create a budget.

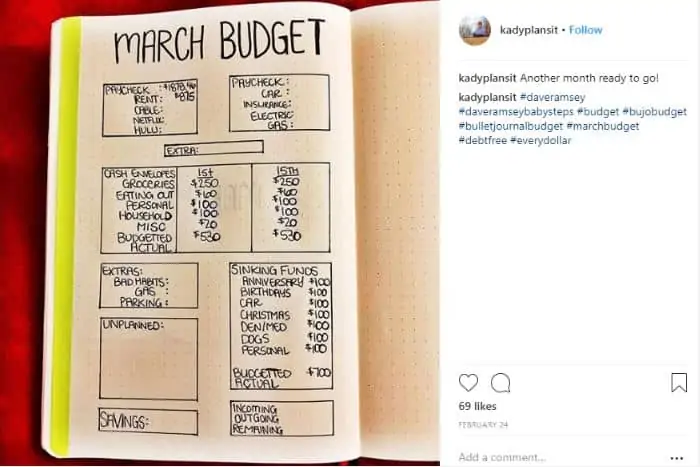

I love to use excel because it’s a nice way to capture a snapshot of my income and expenses on the computer but if you’re into bullet journaling I gathered some pretty cool ideas to help you organize your money like the one above.

I recommend recording your last month income and expenses (if you have a consistent monthly income) to get an idea of what you’re spending your money on and decide how much you can put towards your debt-pay-down plan.

If you find yourself overspending in areas like groceries, clothes, gas, entertainment, etc. I recommend using the envelope system. Have you ever heard of it?

Here’s how it works:

- Figure out how much you can afford to spend on these items each month

- Take out cash for each category and put them in individual envelopes and label each i.e. Groceries

- You can only spend what’s in the envelope for the month, NO exceptions so spend wisely.

Rinse and repeat each month.

This system keeps you accountable and most importantly on track with your budget.

These are my favorite envelopes to use and you can get them from Amazon for the low!

3. Reduce Your Expenses

After recording your expenses from the month before it’s time to take a look at what you can cut or reduce.

Consider the following ways to reduce your expenses:

- Decrease your grocery budget

- Lower your interest rates (I’ll talk about this shortly)

- Cut the Cord (Netflix? Roku? Sling?)

- Negotiate Cable (if you’re not ready to cut the cord), Phone Bill, and Car Insurance. You NEVER know until you ask.

- Take advantage of higher deductible insurance plans for a lower monthly cost BUT you’ll need to have an emergency fund established before considering this

- Trade-in your car for something with a lower monthly cost or no payments at all

You can also create better spending habits. We still have to spend money, so do it wisely like…

Internet Purchases – When I know I want to purchase something and I don’t need it right away, I buy it online (if shipping is free) to take advantage of my Ebates cashback rewards and to find the best deal. You can see how much I’ve made using Ebates here.

I also use Honey to find me the best deals online right before I purchase. If you use Amazon this is a MUST-HAVE tool as it finds you the best price for whatever items you’re trying to purchase.

For more top ways to save on a tight budget click here.

4. Increase Your Income

Using the Snowball Method, you now have a plan of attack. By creating a monthly budget, you can get an idea of how much money you will be able to put towards your debt.

How’s that looking?

For most people, cutting expenses is just the beginning but to be able to put a big dent into your debt you’ll need to make more money.

I’ve created a list of side jobs you can do while still working a full-time job to help you pay off your debt and additional ways to make money from home.

This is also a time to try and get promoted or start your own business.

No work is beneath you when you are broke.

Anything that will get you closer towards paying off your debt, you’ll do it because you want it bad enough, right?

My sister is working toward becoming debt-free and picked up a side hustle reselling products on Amazon and earning over $2,000 per month while holding down a full-time job.

You can check out how it all works in my How to Sell on Amazon article.

Question – What do you do with your tax refund IF you get one?

This is how I put a big dent into my student loans and car note. After getting married we started getting a nice lump sum of money during tax time and instead of spending it, I put it all towards my debt.

This is the only reason I could pay off my debts so quickly. Here’s how you can maximize your tax refund.

We were finally able to enjoy our tax refund this year, but do you know what we did with it? Invested it in a Traditional IRA (I typically recommend only Roth IRA’s but there was a tax benefit this year for Traditional so we opted for that)

If you receive a tax refund and you’re trying to attack debt, I definitely recommend putting it toward your debt.

5. Refinance Your Debt (But READ this first)

If you have consumer debt like credit cards or a personal line of credit with a high-interest rate your main goal is to reduce the interest rate as low as you can.

Take a moment and enter your information below to see how much you currently owe with interest and see how Debt.com can reduce that.

There are credit card companies out there offering lower rates BUT there is ALWAYS a catch. They are banking on you to fail so they can make money off of your interest and fees.

They know this routine TOO well, so only consider the options below if you can afford to pay your bills in a timely manner.

- Pay Off Debt with Balance Transfers – Yup, use a credit card to pay off a credit card. Many credit card companies offer 0% introductory offers for 12 to 18 months. Take advantage of these offers if approved. You can even sign up for new ones and transfer your balance every time the introductory period is over if needed. PLEASE either pay off the credit card within the specified introductory period OR transfer to another offer because the interest rate after the introductory period is ASTRONOMICAL. THIS is how they get you.

Please Note: You may have to pay a balance transfer fee, so be sure to do the math to see if this makes sense but a few credit cards offer 0% APR balance transfers for no fee.

Magnify Money is the only site I recommend for finding the lowest credit card interest rates and cheapest personal loans AND its FREE!

- Use a Personal Line of Credit – Work with your bank or credit union to get a personal line of credit. These interest rates are still high but could be significantly lower than what you are already paying. Write yourself a check and use that money to pay off your higher interest rate credit card and then work to pay off that personal line of credit. Do the math first to make sure this makes sense.

- See What Refinancing Options Your Credit Card Company Has Available – Many credit card companies offer repayment options to lower your interest rate because they’d rather you pay something than risk default. Call today to see what you can do to lower your interest rate, you won’t know unless you ask.

6. Find Loop Holes to Get Rid of Student Loan Debt Like…

- Public Service Loan Forgiveness Program – If you are employed by a government or not-for-profit organization, you may be able to receive loan forgiveness. PSLF Program forgives the remaining balance on your Direct Loans after you have made 120 qualifying monthly payments under a qualifying repayment plan while working full-time for a qualifying employer. You can click here to see if you qualify.

- Use the FREE Student Loan Excel Payment Calculator – This free tool acts as an interest calculator, student loan refinance calculator, REPAYE, PAYE, and IBR loan calculator, calculates payments, and more. The calculator is designed to uncover savings and save a ton of time understanding your student loans

- Consider Refinancing BUT keep in mind when you refinance, you lose income-based repayment, forbearance, and loan forgiveness. That’s a lot to lose out on for a 1% to 2% lower interest rate. Refinancing is smart to do if the math makes sense, here is an EXCELLENT article that goes in-depth about your refinancing options.

7. Track Your Debt Obsessively

When you track your debt obsessively it stays top of mind. This makes it easier to make better decisions when trying to save money. Your goal is to get your debt down to zero at all costs.

Record everything in a spreadsheet or this FREE calculator and track it. It’s a great feeling to see that you’re making a dent in your debt.

Celebrate each time you pay off a debt (frugally) and stay focused.

8. Consider Bankruptcy

I don’t like to recommend this option because it messes with your credit for 7 years but if you have SO much debt and your time to pay off your loan is greater than 7 years then this is something to consider.

Find Laws describes the debts that are not dischargeable for bankruptcy as student loans (unless the court rules otherwise), child support and alimony, certain taxes, and debts incurred by fraud.

If you’re considering this, definitely talk to a bankruptcy lawyer in your area to see if you qualify and the repercussions.

Final Thoughts

While working toward paying off your debt, remember never turn down free money like your 401K. If you work for a company that matches up to a certain amount, take advantage of that and match it.

Are there any steps that you are taking not mentioned above to get out of debt? Let us know in the comment section.

Make sure to join our FREE mompreneur tribe on our exclusive email list. Where we send out new mom jobs, financial tips, and more! Subscribe here.

You Might Also Like:

Wow, great article. I really liked the way you explained the first two points.

Thanks Aiden!

Now I have a guide to to minimize debt hopefully into Zero Debt.Thanks For this 🙂

Awesome!!!