How to Become a Millionaire – From a Stay-at-Home Mom

How to Become a Millionaire at Any Age

Do you want to become a Millionaire?

I know, silly question. I mean, who wouldn’t. Contrary to popular belief ANYONE can become one, AND you don’t need to earn a six-figure income either. I know you may think this sounds crazy but let me show you how to become a millionaire.

Let me first explain what I mean when I talk about becoming a millionaire. I’m not going to talk about the many ways you can make a million dollars and I can’t teach you how to become a millionaire in 3 months, but I’m going to talk about how you can save a million dollars and live off of that income. It’s called retiring early.

Later on in this article, I’ll show you exactly what I’m doing to become a millionaire and keep in mind I’m a stay-at-home mom. But first, I have to share what I saw the other day.

Quick question: Are you on our email list? If you’re a mama like me, you definitely want to be on our list where we send out regular new mom jobs, productivity tips, and inspiration to get through this tough yet awesome journey of motherhood. Click here to subscribe.

This post contains affiliate links, which means I may receive a small commission, at no cost to you, if you make a purchase through a link.

While watching TV, Rachel Ray’s show came on with special guest Chris Hogan. It was a segment about how anyone can become a millionaire at any age.

Chris had everyone in the audience stand to find out how many in the audience were living like Millionaires.

Note: The statistics he brings up come from surveying 10,000 everyday millionaires.

He asked the following questions and for the audience to remain standing if you…

- Use Coupons (According to his studies 93% of Millionaires use coupons)

- Spend $200 or less at restaurants each month (On average Millionaires spend less than $200/mo. Hint: they cook)

- Have a credit card balance that you can pay off immediately (73% of Millionaires don’t carry a credit card balance)

- Use an investment professional or financial planner? (68% of Millionaires use an investment professional so they’re not going at it alone)

As you can imagine there were only about 5 audience members still standing.

If you answered yes, congratulations, you are living a millionaire kind of lifestyle and/or have millionaire kind of habits.

He stressed that if you couldn’t answer yes to all of those questions, it’s okay. It’s all about decisions and being intentional with money.

He also made a very good point that 79% of Millionaires did not receive an inheritance, they built wealth themselves. So if you think most millionaires come from money, well, you’re wrong.

I was also very surprised to hear that 68% of Millionaires avoided student loan debt. They were allergic to debt even with education. Are you surprised too? Sometimes I just assume if you go to a big University you’ll be bringing in the big bucks and forget about the student loan debt they may be drowning in.

Like Chris said, it’s all about decisions.

Can you consider community college for the first two years, go part-time, apply for scholarships, etc. Consider your options, and if it’s worth the financial burden of the school you attend.

AND get this…1/3 of Millionaires never made a 6-figure income! I was totally shocked by this, and this is why ANYONE can become a millionaire because it all boils down to being disciplined.

Like my girl FIREcracker said, “The key is your expenses. If you don’t earn a 6-figure income, but your expenses are low, you can retire faster than someone who earns way more but has much higher expenses.”

What’s Your Number?

Chris said it best; retirement isn’t an age. It’s a financial number.

For most people who want to retire early or at all, they’ll need to save a million dollars or more.

Chris developed the coolest FREE tool, Retire Inspired Quotient to help you discover when you can retire. He said you can’t chase what you’re not aware of, so let’s check it out.

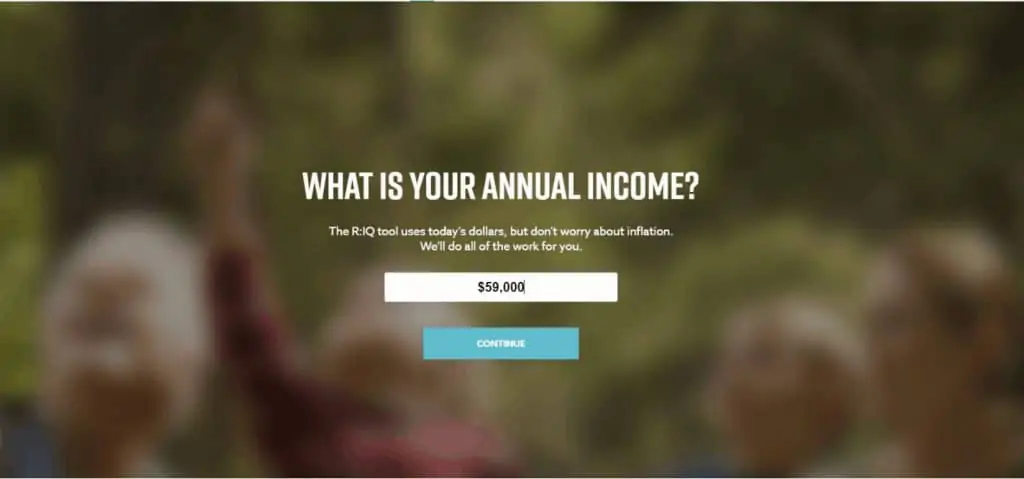

We’ll use this common example to show you how the tool works.

How to Become a Millionaire from Nothing

Say you make $59,000 a year with nothing saved (like most Americans) and that’s the kind of lifestyle you want to live on, $59,000 a year when you retire.

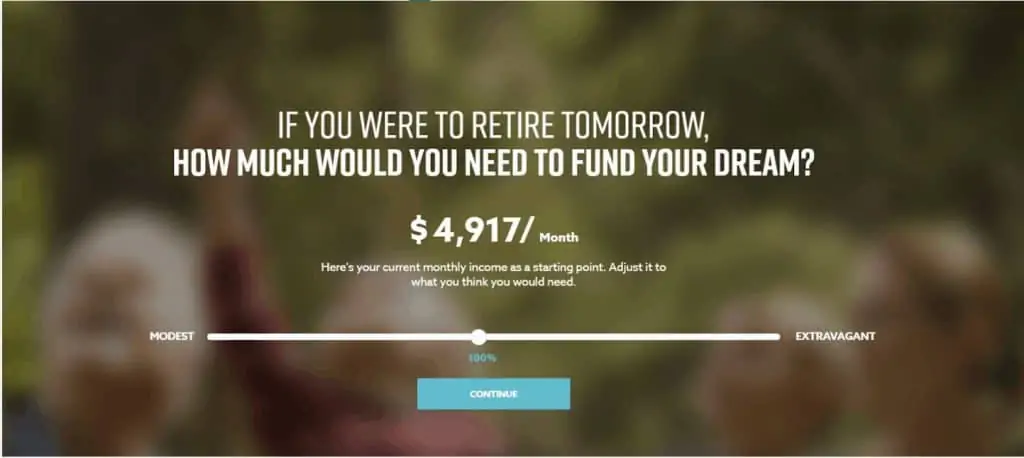

If you were to retire tomorrow and you were going to live off $59,000 a year, you would need to draw $4,917 each month from your investment portfolio.

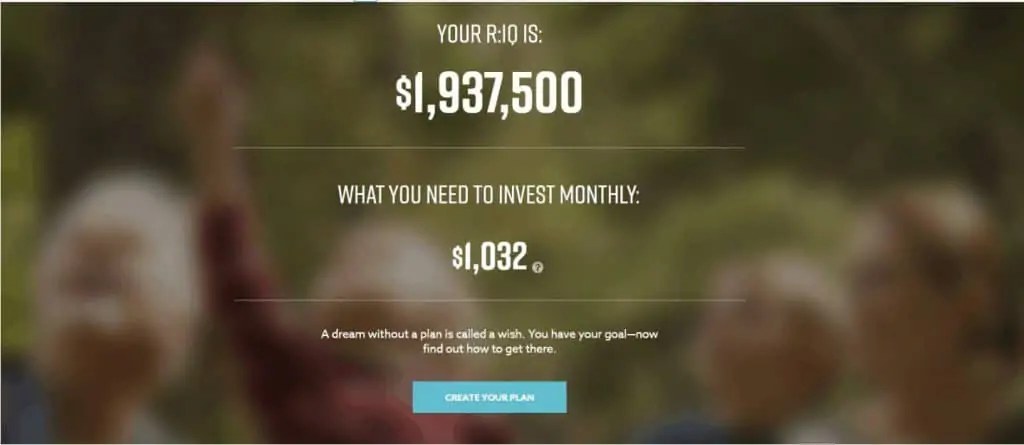

So, let’s say you want to retire in 25 years with nothing saved. To live on $59,000 a year the Retirement Inspired Quotient tool says you’ll need to start investing $1,032 each month.

You’re probably thinking $1,032 is a lot of money to save each month, but Chris broke it down. The average car payment a month for most Americans is $578 for an average of 5 years.

If you can attack debt, get that car payment out of your life by paying it off and put that $578 toward your investment fund instead of sending it to the car company then your goal becomes more achievable. With a little thought, effort, and saving, anyone can learn how to become a millionaire from nothing.

You have to focus on getting out of debt first.

If you have any debt, you have to check out my article here on getting out of debt…it’s GOLD and it will help you get out of debt faster.

It’s all about being intentional. Do you want to retire early or at least prepare?

You can also cut down debt quicker and contribute to your investment portfolio by making more money, check out these different ways to make money from home, or consider starting your own small business.

Just because you might have a million-dollar portfolio doesn’t mean you should spend frivolously. Remember, for this to work that means you are living on a set income each year, so you’ll need to spend wisely.

Here Are Some Good Articles on Saving:

Chris gave one more final tip, “take advantage of your company’s sponsored 401k and Roth IRA it’s a great way to grow money tax-free. You have to put money away in order to have money to spend. You can build wealth; you just have to make decisions and work a plan.”

I’m telling you, after listening to this guy I’m a fan!

How to Become a Millionaire Book

He wrote the book Everyday Millionaires, I definitely recommend you check it out.

Use this investing guide tool to find out what “your number” is and how much you’ll need to save each month until you can retire.

Once you do that, the next big question is, how and where do I save my money for this to work? The answer is, index investing.

Index investing is an inexpensive, effective investment strategy that matches an index fund. You DO NOT NEED a financial advisor in order to invest, you can do this yourself.

An index fund is a mutual fund (or collection of investments) that follows a market (Stock, bond, real estate, etc.). You’re not investing in one individual stock but the whole index like the ever popular S&P 500 (500 of the largest US companies).

I’m putting my money where my mouth is and I’ve invested my entire 401k and IRA into index funds after leaving my job to stay home with my kids.

I put my money in a very aggressive fund called VTSAX thanks to the advice of legend J.L Collins in his stock series. (This is what I did, make sure you do your own research and choose what’s best for you). I’ll move this money in a more conservative fund as I get older to protect my investments.

Index Investing typically always outperforms actively managed mutual funds and due to its diversified strategy your account will never go red. There is risk in anything you do when it comes to investing, but history has shown if the index has gone down, it will always go back up.

I’m not an expert when it comes to investing, and that’s why I chose to invest in index funds. They are low-cost, low maintenance, and the easiest way to diversify your money. Wallstreet tries to make investing so complicated but it’s really not.

Index investing makes investing easy and simple.

Investment benefits take time, so if you were hoping to become a millionaire in 3 months you would have to win the lottery or inherit a large sum from late Aunt Gertrude.

For more information about what Index funds are CNBC wrote a great article, Here’s exactly what an index fund is—and why it’s Warren Buffett’s favorite way to invest.

I interviewed Kristy aka FIREcracker who blogs at Millineal-Revolution, and she retired at 31 with a million-dollar portfolio! She is the reason I’ve become obsessed with achieving financial freedom.

Here is What I’m doing to Become a Millionaire from Nothing:

- I’ve paid off all my debt except for my mortgage. I used my income tax refunds to help pay off my student loans and car payment.

- I signed up for Mint.com to track my expenses and create a budget

- Cut Expenses – Using Mint I was able to see where we were spending too much money, so I cut back some expenses and started putting that money toward our investments each month

- Contribute the Max to Roth IRA and Traditional – Following Chris Hogan’s advice, my husband and I contribute the max of $5,500 each to grow our money tax-free in a Roth IRA

- Being smart with our money – We live a very frugal lifestyle, but we still enjoy life with our kids. We just do certain things like:

- Use a credit card on everything to take advantage of cashback rewards. We receive over $600 in cashback rewards each year because we purchase EVERYTHING on one Chase credit card and pay the monthly statement off in full (Say No to Interest) so we can reap the benefits of cashback rewards. We don’t spend money on what we can’t afford. If you sign up for the Chase Freedom Credit card as we did you get a $150 bonus if you spend $500 within the first 3 months. That should be easy to do if you use it on everything like us.

- Take advantage of Hand me Downs – We rarely spend money on clothes for our kids because we make it a point to ask family and friends to pass down the clothes whose kids are slightly older than ours.

- Meal Plan – Food is our biggest expense, and I do what I can to save as much as I can. Subscribing to Meal plans has actually saved us money too.

- Savings – We have worked hard to build up our emergency fund (6 months of our monthly expenses) and money if our car breaks down or unexpected home repairs. We don’t want to get into another debt trap and pay interest on something we can’t pay in full.

- Invest – Each month we contribute money to our brokerage account. This is money we have leftover after all of our expenses are paid. We also put money away towards vacation plans and entertainment (we still have to live and enjoy life) and any money that’s left over is put into our brokerage account because it’s no point in putting money in a savings account with a .001% interest rate. We are using JL Collins method in his stock series to invest. Definitely check it out, it changed our lives.

How Long Until I Achieve Financial Freedom? I don’t know yet and to be honest, I’m doing what I would be doing even if I retired early.

Retiring early is really for my husband and not so he can be home with me all day, but so he can find what he’s passionate about.

I’m a stay at home mom and I make money from my blog, so I’m already living my dream. To be able to raise my kids, be “there” and make money is really all I could ever ask for (on my own terms).

I’m a year into this blogging game and I’m making more money now than when I was a full-time Corporate Marketing Manager. You can see how I make money blogging here.

Blogging has given me the freedom to do so much, I just wish I had known about this sooner, but everything has its timing. If you’re interested in starting a blog I wrote a step-by-step guide to get you started. Blogging with the right motivation and a little bit of luck can become a job that makes you a millionaire.

Let’s Recap the Steps You Need to Take to Become a Millionaire

- Focus on Paying Off any Debts

- Earn More than you Spend

- Invest Early

- Increase Your Income

- Cut Unnecessary Expenses

- Live a Frugal Lifestyle

I hope this article sparked something in you to work toward becoming debt-free, being smart with your money, and becoming a millionaire from nothing.

Can you do it?

Make sure to join our FREE mompreneur tribe on our exclusive email list. Where we send out new mom jobs, financial tips, and more! Subscribe here.

You Might Also Like:

20 Passive Income Ideas from Millionaires

30 Ways to Make Money from Home that Pay Well

Paying Off Your Mortage Early vs. Investing – What You Should Do

Great post. I live in the UK so things are different here but I can apply most of your suggestions. I think ive mastered the frugal living element so my next step is about investing and growing worth. Thank you for taking the time to write this post

Thank you, I’d love to visit the UK. Yes, investing is key. I’m glad you enjoyed this article 🙂

Outstanding article ! I am on the same page with you having many of the same lifestyle values and absolutely HATING interest. I strategically take advantage of those 0% interest deals on credit cards to help me do some of my real estate investing. I love this concept of becoming a millionaire and retiring waaay early. Your article and some of the resources you included have helped me immensely. Thank you !

Yes, we do the same with the 0% interest deals. I’m so glad you enjoyed this, I love that we are on the same page!

There are soooo many EASY tips in here! Thanks, Max! Still working to pay off debt and working to diversify income streams.

-Lindsey

That’s awesome, you can do it!

I enjoyed reflecting on many of the millionaire lifestyle tips, but I’m struck with curiosity about why you are choosing to eliminate mortgage debt rather than save? It’s a reasonable choice, but I’ve gone back and forth over the years and it always makes me curious.

Thanks Robert! I quoted this comment in my article “Should you Pay Off Your Mortgage Early or Invest?” and I couldn’t have said it better. This is why I’m doing what I’m doing, “I chose to pay off the mortgage and have absolutely no regrets. Would I have made more money if I had invested? Probably, given the huge bull run that we have witnessed, but that is in retrospect. If the market went down I could have just as easily lost money.

So I went with the guaranteed return of my mortgage interest. Plus being completely debt free has given me so much more non-monetary benefit (peace of mind, ability to now invest the previous mortgage payments which lessens the gap of benefit between investing/paying off mortgage)”

Fascinating! Had no idea that millionaires used coupons. In hindsight, it kind of makes sense because one of the reasons people who have great salaries never make it to a millionaire status is because they thoughtlessly spend it. I live in a big city and it’s so common to spend money on branded items just to show off.

Side question … how long have you been investing in index funds at this point? Have the trends fluctuated for you?

I’ve been investing in index funds for over a year and I don’t look at it because its all about the long haul. I know the market will go up and down and I don’t need to see when it’s down 🙂

Love this! My husband and I are working on paying off our mortgage too. Maybe we can meet up in Nashville for a holy ghost filled debt free scream. Lol I definitely can benefit from couponing and meal planning. I’m going to read more about it. Thanks so much!

Yes we do!!

Thanks for the useful tips! Loved the quote “retirement isn’t an age; it is a financial number.” I have been investing in index funds for quite some time. It’s one of the best( and passive) ways to build a sizable retirement portfolio in the long term.

Thank you for this information! I feel very encouraged by what I have read. Apparently, my husband and I have been living closer to a millionaire lifestyle than we realized. Thank you again for breaking this information down so concisely. It has been very helpful for us as we transition into a new season of family life.

No problem, glad you found this article helpful 🙂

Wow, this was really insightful. I guess I am living a retired millionaire lifestyle already. I definitely need to get that book. Thanks for the great article.

Awesome, and thank you!

When you invest, you’re buying a day you don’t have to work.